A couple of most significant bits of suggestions throughout the borrowing report are your credit score and your credit history.

A credit score is a rating the financing bureau gives you because the a debtor. It include 300 to 850 consequently they are calculated that have situations together with your payment background, an excellent expenses, and duration of credit history. Your credit history measures how long you may have handled certain lines from credit. Your payment background tracks even though you overlooked people costs in those days.

Very loan providers need the very least rating out-of 600 to be eligible for a loan. Into the 2020, a good BankRate survey shown 21% off U.S. users experienced a credit card applicatoin declined on account of the lowest credit score. not, specific lenders promote alot more versatile standards to own consumers which have less than perfect credit. Particularly, BrightUp now offers compassionate investment when it comes to an urgent situation Loan. This 1 does not have any the very least credit history needs. We likewise have a debt consolidation and you can Re-finance program that uses solution underwriting to enhance accessibility reasonable prices. When you are poor credit lenders try much harder to acquire, they do are present.

dos. Earnings

Prior to recognizing your application, a lender has to be positive that you may have adequate constant earnings to repay your loan. Even if you have a good credit score, you happen to be less inclined to get approved when you find yourself in-between services or are requesting more funds than simply you really can afford so you can pay. The minimum money standards to obtain a personal bank loan vary of the financial by amount borrowed.

You might establish your earnings with current taxation statements, bank comments, spend stubs, or a signed letter from your manager. While thinking-employed, you will be expected to give the taxation statements and you will bank places.

3. Debt-to-Money Proportion

Even although you features an effective credit score and you may proper income, loan providers would not fundamentally undertake the loan. Such as for instance, guess you’ve currently taken up high costs. In this case, there can be certain anxiety about what you can do and make any additional repayments every month. The debt-to-income proportion is the part of your monthly earnings that is currently designated because the payment to have pre-established bills.

When you are lenders might have additional loans-to-money ratio requirements, you are in new secure territory in case your proportion is thirty six% or quicker.

cuatro. Guarantee

Don’t assume all personal loan needs security, but some consumers could need to control guarantee whenever applying for a loan. If you want to rating a secured personal loan, you will be necessary to promise worthwhile possessions security-such as for instance, your car or truck, home, otherwise savings account. Equity handles the financial institution for folks who fall behind on the payments or default on the financing. The lender often repossess the brand new guarantee to cover the leftover balance in your mortgage.

Concerning Application for the loan

Conditions for a loan may vary of financial so you’re able to lender. Particular loan providers are able to work at applicants that have down borrowing results. Having said that, other people have minimum conditions you to definitely shut of numerous individuals away. Although not, the borrowed funds application and you can comment procedure is similar for some elitecashadvance.com loans with no job loan providers.

To show their creditworthiness according to research by the factors over, try to bring higher-height information that is personal and you can official records.

Evidence of Label

So you’re able to qualify for a loan, you ought to prove that you are at the very least 18 ages old and a resident of your own You.This is certainly one of the primary contours regarding defense against label theft from inside the credit. Types of acceptable different identity include:

- Driver’s license

- State-awarded ID

- Passport

- Delivery Certification

- Army ID

- Certification out-of citizenship

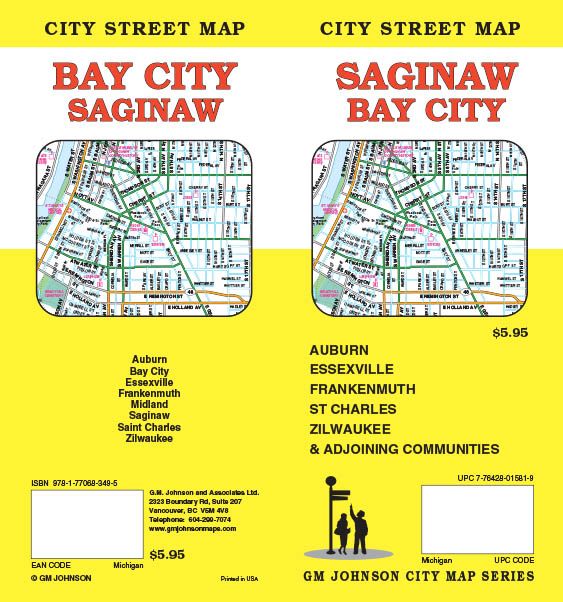

Proof of Target

Such as borrowing from the bank unions and you may community finance companies, particular lenders wanted one consumers real time inside a selected service footprint. For others, they want where you are information so they can send one debts or files to you personally. You can provide proof target with an article of post, a recently available household bill, their rental arrangement, or a voter membership cards.